Contents

Recently, FXCM has been criticized for taking its brand name and recognition for granted and as an excuse to raise its prices. Therefore, if FXCM’s expenses are of concern to you, it is advisable to check other alternatives with much better trading conditions. Choosing FXCM gives traders an advantage by having relatively lower trading fees, competent research tools, and decent mobile trading platform offerings. When depositing accounts, FXCM traders can opt for credit or debit cards with no deposit charge. They can also go for a bank transfer, and wire transfers through Skrill, Neteller, and UnionPay. Though its withdrawal requests are also free of charge, it takes up to three days for the requests to be processed.

If brokers break the rules, FINRA is empowered to fine, suspend or bar them from the securities industry. Among the illegal activity FINRA looks out for are insider trading “and any strategies firms or individuals use to gain an unfair advantage.” The sale of “get-rich-quick” trading systems, negligent analysis and outright market manipulation are ever-present in the online trading environment. Subsequently, many unsuccessful traders have fallen victim to at least one of these profit-killing enterprises. Scams and outright fraud have been a part of the financial world since the roots of exchange. From nefarious mutual funds to stock scams, there are many examples to point to throughout history.

- Likewise, the seller often tells investors that there is a “secret” behind the investment that they are unable or unwilling to divulge.

- Elie Wiesel, the late Holocaust survivor, said his Foundation for Humanity lost US$15.2 million in the scam.

- In Forex trading, money is the commodity traded between participants.

- All these trading platforms have mobile app versions for traders who opt to trade on their tablets or smartphones instead of through the web.

- FINRA also provides surveillance and other regulatory services for U.S. equities and options markets.

- For full-time traders, being able to apply leverage is vital to making the most out of their risk capital.

May you provide us with enough opportunities to serve you once again. Inflated Returns – Scammers often claim massive historical returns and will show numbers that way exceed market norms to lure investors in. FXCM also exercises the negative balance protection for its traders residing in Europe.

Availability Of Leverage

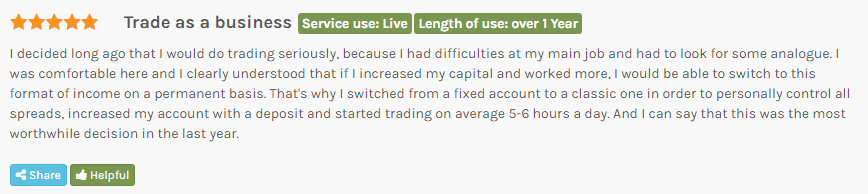

Regulators also check that brokers are not making unfounded claims or using dubious marketing tactics. Furthermore, in the case of a conflict, investors have a level of recourse with a third-party body whose express obligation is to protect investors. Beyond regulation, investors should also check reviews from trustworthy sites online where they can read about experiences of other real traders. Many review sites also thoroughly investigate complaints, as well as safety and security issues, such as KYC policies and website encryption standards. Operating in Europe, Africa, and Asia-Pacific, FXCM has established its name across continents in the last two decades. As one of the pillars of forex brokerage, FXCM is a good choice for forex traders.

The ability for traders and investors to enter a given market at near-light speeds has created the possibility of sudden, sometimes unpredictable, swings in price. While remote market access has many advantages, there are also disadvantages of online trading. To succeed, one must be disciplined, technologically proficient and have a winning mindset. Unfortunately, these attributes are lacking in countless beginners and aspiring full-time traders. Ponzi schemes get their name from Charles Ponzi, who perpetrated a fraud in the early 1920s in New England promising investors a 50% return on their money in 90 days.

Still waiting 4 days for deposited funds into my Live trading account to be cleared by FXCM. Forex is by far the largest financial market in the world, with over $6 trillion traded daily globally. https://forexbroker-listing.com/ That staggering figure, coupled with the magic of leverage, always means that there is immense opportunity to make profits in the Forex market, even though this comes with a lot of risks as well.

No matter what time of day it may be, it’s possible to stream real-time quotes and execute trading strategies. The arena of online trading offers many advantages and disadvantages to individuals interested in engaging the world’s financial markets. The marketplace has evolved over time from an open-outcry auction system fxcm canada review to a predominantly digital format. Throughout the transition, technological advances have made remote, real-time trading possible from nearly anywhere in the world. Friedberg Mercantile Group Ltd. (“Friedberg Direct”) is an independent legal entity and does not own, control or operate this third-party website.

Clients are also subjected to bonuses and promotions when achieving certain conditions. If you want to trade online, it is vital to avoid scams by only trading via regulated brokers, with a long track record, impressive reputation, industry awards and high client satisfaction. When you are trading with Friedberg Direct, you are trading with a reliable and trustworthy partner that is very much invested in your success as you are. Friedberg Direct is a reputable brokerage firm that has achieved regulation in Canada. There is a free demo account for investors who wish to ascertain the services of Friedberg Direct before committing their time, money and resources.

FXCM’s VIP account is among the most expensive trading accounts considering services from other brokerage firms. However, it seems that the firm is taking advantage of the investors by capitalizing on its image as a broker. This is a blatant display of the firm’s advances for bigger profits while there are better trading accounts offered by other brokerage firms.

What Are The Pros And Cons Of Forex Trading?

Retail investors mostly trade Forex as CFDs , where there is no obligation to own the underlying currencies traded. When trading CFDs, investors are speculating on the price changes in financial assets, which means they can profit from both rising and falling prices. Decentralisation also means that the market is not controlled or supervised by any single entity or institution, but rather by regulators or authorities in different regions. In Forex trading, money is the commodity traded between participants.

However, FXCM does contain a varied choice for trading platforms, which cannot be said for all firms. Some of these trading platforms include MetaTrader4, NinjaTrader, and its platform, TradingStation. All these trading platforms have mobile app versions for traders who opt to trade on their tablets or smartphones instead of through the web.

At the time, this practice was legal before becoming outlawed in the 1930s after the crash and onset of the Great Depression. Trade your opinion of the world’s largest markets with low spreads and enhanced execution. FXCM succeeded in taking a large portion of the market, owing to the reputation it has built by promoting the firm in many places all over the world throughout its time. Bulliscoming is your crypto news, business, finance, airdrop & price prediction website We provide you with the latest news and videos straight from the crypto and economy industry. You are provided with free forex educational courses to kick start your trading endeavor towards profitability. The particular account I’m thinking of has $9.99, so I best be using a larger sum of money.

List of Best Forex Brokers in Nigeria

These charges and penalties created a bubble of distrust within its existing investors and other interested investors, tainting the reputation the firm has built-in its early years. Ever since issues of misconduct broke, the firm has attempted to repair its reputation by offering better services to its clients. It has launched newer, reliable forex services operating in the best interest of its clients.

We put great effort into ensuring that our clients are assisted promptly and effectively, and we are glad to hear that this was the case with your experience with Daniel as well. Inflated accuracy – Claims like “90%+ accuracy” are an immediate indication to be cautious. Even the best traders and technology cannot achieve this level of accuracy. With a little investigation, you can actually check their previous signals against historical market data. Promises of unlimited profits – Scammers will claim things like, “churn out endless profits from the markets round the clock” or “guaranteed profits”. This is simply not true and even the best and most reputable solutions cannot ensure 100% accuracy or even close to that.

FXCM is one of the first brokerage firms to offer a trading platform for foreign exchange trading and capitalize on the growing interest in currency exchange among new investors. Almost two decades after its establishment, FXCM is currently among the most well-known firms in the market, conducting transactions worth billions of dollars per month. The modern incarnations of currency, equity and derivatives markets have given people from all walks of life the opportunity to participate in what was once limited to the privileged few.

FXCM: Trading Platform & Payment Options

This particular account has low commission rates, and average spreads are available to moderate high volume traders. Unlike its offered Standard account, the Active Trader account charges its users a commission per trade along with a reduced spread. To date, FXCM accounts for billions of dollars of its trade transactions monthly. FXCM’s early foundation helped it to become one of the more popular forex brokers online. Through its Investor Education Foundation, FINRA provides individual investors with tools and resources to help them make sound financial decisions and to protect themselves from financial fraud. For example, investors can use its online Fund Analyzer to compare expenses among different funds.

The first step to identifying a trustworthy broker is regulation with reputable agencies such as IIROC, ASIC, FSCA, FSA, FFAJ and various others. Regulated brokers are mandated to operate segregated bank accounts for client funds, separate from their working capital accounts. They are also subject to random platform checks that ensure they always offer transparent trading services to clients. As stated earlier, the prerequisites to begin trading securities online are limited. For beginners, all that is needed is risk capital, computing power and internet connectivity. Upon selecting an online brokerage firm and successfully opening an account, one is able to start trading.

As the transactions, which are mostly failures, continue to ask for more deposits, on the pretext that they have found the best techniques to win in the next trade. But for traders, the next step is unexplained losses of money and unauthorized bank withdrawals. The Special Envoy’s report on online scams says more about the reliability of FXGM, which, by the way, is formally distinguishable from FXCM. Bonuses and promotions are quite common offerings by brokers, including legitimate ones. Licensed and regulated brokers have to ensure that their bonuses and promotions meet regulatory guidelines and do not “lock” the trader in. However, some shady brokers lure in investors with promotions that are misleading and have terms and conditions that are so stringent or outrightly unattainable.